Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

Product design for banking and crypto funds

Mobile-first Web app in production

Full time ongoing work since September 2024

15+ people

Figma, Jira

Second designer for collaborative crypto wallet features serving 1,5k users and growing

Core design responsibilities:

Design release documentation:

Trustyfy app was created to empower individuals with complete control over their finances, offering the benefits of modern banking without the restrictions, or vulnerabilities of traditional financial institutions.

Flexibility of decentralized wallets, the convenience of traditional banking features like debit cards and statements, and unmatched user control

As we already had MVP version 1, we needed to do redesign, expanding missing flows and making coherent product in figma and in production.

Our user faces challenges with financial systems that are restrictive, costly, and lack user control, making global transactions and collaborative wallet management inefficient and insecure.

How might we make collaborative crypto management as simple as shared Google Docs?

What interface patterns can bridge traditional banking familiarity with crypto innovation?

According to Revolut's 2024 Annual Report, business customers now represent 15% of revenue despite constituting a smaller user percentage, indicating higher engagement and transaction values—validating our focus on SMB collaborative crypto management.

Wise's 2024 research revealing that US SMBs lost $800M to hidden international payment fees directly supports our design hypothesis that transparent, user-controlled crypto-banking solutions address a quantified market need.

Despite Revolut Business reaching £463M in revenue with 56% growth, only 15% market penetration in key markets indicates significant opportunity for Trustyfy's multi-user crypto wallet approach to capture underserved SMB segments.

Our research aligns with industry trends showing 59% of SMBs increase prices due to payment complexity, while 940M monthly transactions across digital banking platforms demonstrates user comfort with fintech solutions.

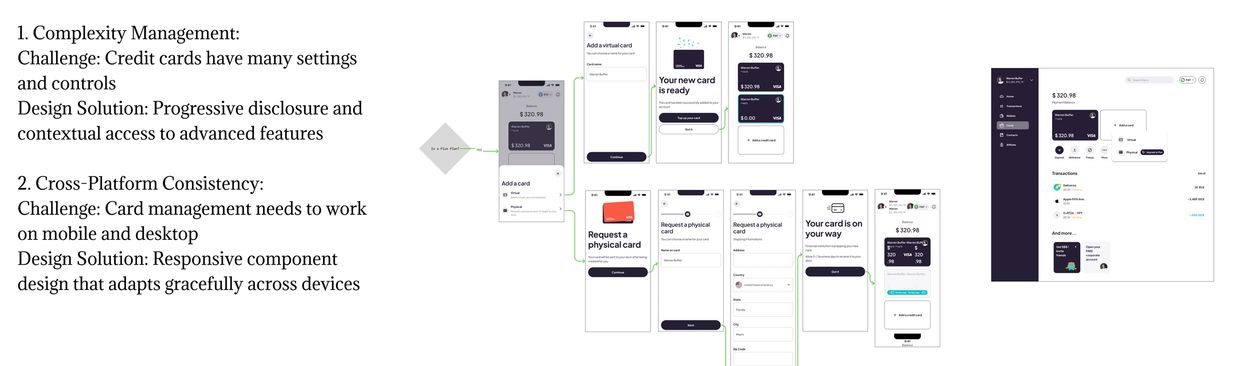

Problem identified for crypto and traditional banking: Existing crypto-backed card solutions lacked the granular control and transparency that business users required. Users needed enterprise-level card management within a crypto-native environment, combined with multi-user permissions that traditional banking couldn't provide.

To address these challenges, extensive market research was conducted:

- Competitive analysis of 8 crypto-friendly banks and 6 traditional institutions

- Regulatory requirement analysis across EU/UK financial services - Task analysis of current crypto-to-banking user workflows

Competitive analysis discoveries:

- 78% of users needed visual clarity on which balance (crypto/fiat) funded each transaction

- Traditional banking UX patterns reduced user anxiety when handling crypto

- Regulatory notifications required careful UX to avoid abandonment

- Revolut/Wise approach: Freemium with usage limits → gradual upselling

- Crypto wallet pattern: Free core functionality, premium features as add-ons

- Traditional banking: Monthly fees for premium accounts with enhanced features

Onboarding & Wallet Setup

Fund Management

Transfers & Payments

Collaborative Wallets

Debit Card & Bank Details Integration

Multi-Device Access

Accessing Affiliate Tools

User Mental Model: "Select a network" = choosing blockchain networks for crypto transactions

The Bridge Mechanism:

Both IAs converge on "Select a network" as the critical bridge between crypto and traditional finance

Design Decision: Expand "Network" Definition

Critical Insight from IA: The creative part of this design is to use "Select a network" as the bridge concept that users already understand from crypto, then expanding it to include traditional finance "Fiat" (Later "Fiat - traditional banking")

Key flows to cover:

Slight overview on how Card activation flow was created:

Design Decision: Card Arrival → Identity Verification → Security Setup → Funding Confirmation → First Transaction Test

Design rationale:

Free user onboarding experience

Design strategy

Demonstrate platform value without restrictions

Onboarding Flow:

Upgrade trigger points:

Design Approach:

Lead with user benefit, not payment request

Paid plan onboarding:

Design decision rationale

Why this structure works:

1. Preserves Core Value Proposition

2. Natural Progression Path

3. Competitive Differentiation

With a current transaction volume exceeding €10 million after Beta release, the product has demonstrated strong early traction and a clear market need.

Design outcomes:

Innovation in fintech UX:

Design system maturity:

During credit card release we set these metrics to track:

Conversion metrics (1-6 months post-launch):

User experience impact:

Work on next steps design focus:

© 2025 thereislora.com - All rights reserved

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.